Thinking about money in 2026 isn’t only about saving. With new finance options, AI in credit scores, and shaky markets globally, one thing is still key: “what are some financial tips that everyone should know?“

The way we handle money now is way different from 10 years ago. Forget stashing cash under the mattress—now, it’s about making your money work hard for you to secure your future. Before we get into some serious strategies, remember that your credit score is like your financial ID. If you’re not keeping tabs on it, you could be losing money without even realizing it.

Hi, I’m Sanford Kuhn (Sanku). Watching the market go up and down since the 2011 credit downgrade and then the 2020 pandemic, I learned that what really matters isn’t just earning money, but keeping it and making it grow.

1. The 2026 “Liquid Fortress” Strategy

Forget the old save three months’ income advice. In today’s job market, with many people freelancing and industries changing fast, you need a bigger safety net – a Liquid Fortress.

-

Beyond the Basic Savings: Normal savings accounts with their tiny 0.05% interest? They’re not doing your money any favors. Instead, consider High-Yield Cash Accounts or Treasury Money Market Funds.

-

The “Two-Tier” Emergency Fund: Set aside one month’s worth of expenses in your local bank for easy access. Keep another five months’ worth in a high-yield savings account to help grow your money and beat inflation.

2. Advanced Credit Engineering

When people ask what are some financial tips that everyone should know?, Most people focus on budgeting, but smart credit management is what *really* leads to big savings.

-

The “10% Utilization” Rule: To keep your credit score high, remember your credit limit isn’t free money. Try to keep your reported balance below 10%.

-

The Micro-Payment Hack: Paying your credit card bill twice a month, instead of once, can lower your average daily balance. Doing this might actually give your credit score a lift of 20-30 points in just one billing cycle.

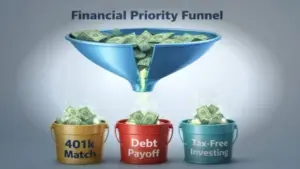

3. The 2026 Investment Hierarchy

Where should your next $1,000 go? This is a critical tip.

-

Employer Match: This is a 100% instant return. Never skip it.

-

High-Interest Debt: Anything over 8% APR (like credit cards) is a financial emergency. Kill it.

-

Tax-Advantaged Accounts: Max out your Roth IRA or HSA. In 2026, tax-free growth is the ultimate hedge against future tax increases.

4. Psychology of Spending: The “24-Hour Rule”

It’s easy to spend too much with the ease of online shopping, and that can really hurt your finances.

-

The Tip: If you’re thinking about buying something over $100, hold off for a day. If you still want it after 24 hours, go ahead and get it. Usually, that initial excitement wears off, and you’ll see you don’t really need it.

Detailed Expert FAQ

Q1: What are some good financial tips?

To handle your finances well in 2026, keep these tips in mind: Make sure you have a good mix of investments and easy access to your money. First, keep an emergency fund with 3-6 months’ worth of living expenses in a high-yield savings account. Second, grab any free money you can get—if your job has a 401k match, put in enough to get the whole thing. Last, guard your credit score. Keep your credit use low (under 10%) and always pay on time, because even one missed payment can hurt your score for a long time.

Q2: What is the $27.39 rule?

The $27.39 rule is a simple mental trick that can help you save $10,000 in a year. Just save $27.39 each day, and you’ll reach your goal. When people ask what are some financial tips that everyone should know?,This is usually the most useful way to save. Just save around $27.39 each day – maybe pass on a fancy lunch, or stop a subscription you don’t use – and you could have a big five-figure safety net by the end of the year.

Q3: What are the 5 C’s in finance?

The 5 C’s of Credit are the pillars lenders use to judge your “creditworthiness.” They are:

-

Character: Your track record of paying back debt (your credit score).

-

Capacity: Your ability to repay based on your income vs. existing debt.

-

Capital: The amount of money you personally have invested in a project.

-

Collateral: Assets you pledge to secure the loan (like your home or car).

-

Conditions: Outside factors like the economy or the purpose of the loan.

Q4: What is the 3 6 9 rule of money?

The 3-6-9 rule is a guide for your money goals. It says to have 3 months’ worth of basic expenses in an emergency fund that you can get to easily. Also, save 6 months’ worth of your full income in case something big happens in life. By the time you’re ready to retire, aim to have 9 times your yearly salary saved up. Think of it as a simple way to see if you’re on the right path for financial security in the long run.

Q5: What is the 7 3 2 rule?

The 7-3-2 rule is a budgeting approach where you allocate 70% of your income to needs like housing, food and utilities, 20% to wealth-building activities like investments and debt repayment, and 10% to wants such as lifestyle and hobbies. Using this method in 2026, with the increasing cost of living, helps ensure financial stability while still allowing you to enjoy life.

Q6: What is the 3 jar method?

The 3-jar method is an easy way for anyone, kids or adults, to handle their money. Just split your cash into three jars: one for saving, one for spending, and one for giving.

-

Saving: For big future goals.

-

Spending: For daily life.

-

Giving: For charity, this system shows you that each dollar should be used for a specific thing, so you do not spend too much by accident.

5. Tax-Loss Harvesting and Rebalancing

To round off the answer to “what are some financial tips that everyone should know?“, we must look at portfolio maintenance.

-

Rebalancing: It’s a good idea to review your investments yearly. If your stocks have ballooned while your bonds haven’t moved much, you may have more risk than you’re comfortable with. Consider selling some stocks and buying some bonds to realign with your initial strategy.

-

Tax-Loss Harvesting: If some of your investments haven’t done so well, you can sell them to cut down on the taxes from the investments that have. That can save you big on capital gains taxes.

Final Thoughts from Sanku

Building wealth by 2026 isn’t about luck; it’s about having a system. If you automate your savings, keep your credit score in good shape, and follow simple guidelines such as saving $27.39 each day, you’ll be more than just getting by—you’ll actually be getting ahead.

Remember, when you ask what are some financial tips that everyone should know?, the most important one is to start today. Time is the only asset you can’t buy back.