Ever checked your credit score and wondered how some people get it up to 800? It’s like winning gold in the personal finance Olympics. With changes in lending because of inflation and the increase in AI credit models coming in 2026, the question how rare is an 800 credit score is more relevant than ever.

Before we get into how this elite group does it, you need the right tools. Knowing where you’re starting from is key for anyone trying to get a top score.

Hi, I’m Sanford Kuhn (Sanku). For the past 10 years, I’ve been keeping an eye on U.S. credit as it changed during the 2011 debt ceiling issues and the market swings of 2020. Now, I’m going to explain how to get an 800+ credit score—and why you can do it too.

The Statistical Reality: Who Actually Holds an 800+ Score?

To understand how rare is an 800 credit score, Let’s examine the most recent data from 2026. About 23.5% of Americans have FICO scores between 800 and 850. While that seems like a lot—almost one in four—they’re not evenly spread out.

Most people with these high scores are Baby Boomers or Gen X. Millennials and Gen Z don’t often hit 800 because they haven’t had as much time to build credit. Right now, the average American has a score of 718. Getting from average to elite means closing an 82-point gap, because it needs nearly perfect money habits.

The 2026 “Trended Data” Shift (FICO 10T)

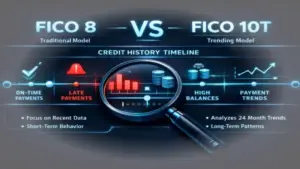

It feels harder to get an 800 score these days because of the move to FICO 10T. Older models looked at a quick view of your debt, but 10T checks out what you’ve been doing for the past two years.

If you’re someone who keeps a balance on your cards each month, even a high credit limit won’t help you much. Now, hitting the 800-club is mostly for people who use their cards a lot but pay everything off each month.

Anatomy of an 800-Club Member: The 5 Pillars

If you want to stop asking how rare is an 800 credit score and start owning one, you need to mirror the habits of the elite. Here is what their data profiles look like in 2026:

-

The 100% Rule: Missing just one payment by 30 days could make your credit score drop from 810 to 690 right away. This could happen even if you haven’t missed a payment in the last 7 to 10 years, and will happen in 2026.

-

The “Ghost” Utilization: Experts suggest keeping credit utilization below 30%, but those with scores of 800 or higher typically keep it under 6%. They essentially treat their credit cards like debit cards.

-

Credit Longevity: Their oldest account has usually been around for 20 years or more.

-

Strategic Inquiries: They don’t often apply for new credit cards unless there’s a huge sign-up bonus. They usually have zero to one hard inquiries per year on their credit report.

-

The Mix: They have what you might call a Healthy Wallet—a mortgage, a car loan, and three to five established credit cards.

Why 800 is the “Magic Number” for Your Wallet

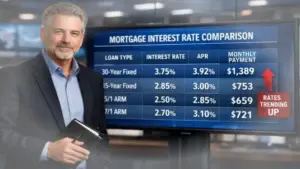

Is it worth trying to boost your credit score? In 2026, having a score of 800 instead of 700 could save you around 1.2% on a $500,000 mortgage. That might not sound like much, but over 30 years, we are talking about $110,000 in interest.

Also, banks like Amex and Chase offer better deals to customers with higher scores. An 800 score could get you invites to private banking and access to high-limit credit cards that most people can’t get.

Detailed Expert FAQ: Everything You Need to Know

1. What is the highest credit score?

The highest possible score for both FICO and VantageScore is 850. But, hitting 850 is more about bragging rights. Once you’re above 800, you’ve reached what’s called Rate Parity. This means you’ll get the same mortgage rates, insurance costs, and credit card offers as someone with a perfect 850. Those extra 50 points just act as a buffer if your score dips a little.

2. What is a good credit score?

By 2026, expect that getting a loan will be harder because banks are getting pickier. A good credit score will land between 670 and 739. With a score in that area, you’re a solid borrower and should get approved for most loans. Still, you probably won’t qualify for the super-low interest rates. If you want those, you’ll have to push your score above 740 into the very good range.

3. What credit score do you start with?

A common misconception is that everyone starts with a score of 0 or 300. Actually, you start with no score at all—you’re invisible to the system. To get a FICO score, you need at least one account that’s been open for six months and is reported to the credit bureaus. If you handle that first account well—like a secured card or student loan—your initial score will likely be between 650 and 710. After that, you can work your way toward a score of 800 by continuing to manage your credit well.

4. Is 750 a good credit score?

Yes, a 750 is a great credit score, putting you in a good position for borrowing. With a score like that, you’re ahead of most people, and banks see you as a safe bet. You might be curious about getting an how rare is an 800 credit score, but a 750 is usually enough to get good financing on things like a Tesla or a large mortgage. Going from 750 to 800 mainly benefits those wanting top-tier insurance discounts and credit limits.

Final Thoughts from Sanku

So, how rare is an 800 credit score? Building good credit takes work, but it’s not some mystery. By 2026, credit scores will mostly rely on data. If you consistently give credit bureaus the right info – like keeping your credit use low, paying bills on time, and building a credit history – they will likely give you the score you’ve earned.

I’ve seen people with bad credit become Elite in under two years just by following these simple steps. Your financial well-being depends on your credit score, and a good score really lets you keep more of what you make.