New US Credit Card Interest Caps 2026, This week marks a turning point in the long fight between government regulators and big banks. Starting in early 2026, the CFPB is putting strict limits on credit card interest rates and late fees. The goal is to keep many Americans out of serious debt. Although this seems good for consumers, it will really change how you use and get credit this year.

Secure Your Low-Interest Future –

The Breaking News: Why the Cap is Happening Now

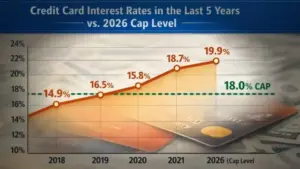

Over the last ten years, Credit Card Interest rates have steadily increased, with many people facing rates above 29%. But in 2026, a new federal rule will limit how much interest lenders can charge based on risk. This is intended to do more than just save people money; it’s meant to break the cycle where interest grows faster than what you actually owe. Banks are now working fast to change how they do business, since high-interest debt—their main source of income—is now restricted.

The reason for this change is simple: while the economy is getting better, people owe more than ever. By setting a limit on credit card interest, the government hopes to give households more spending money by cutting down on monthly interest payments. But, as any finance expert will say, banks usually find a way to make money. So, how will your bank respond to these smaller profits?

How Banks Are Responding to the Interest Limit (New US Credit Card Interest Caps 2026)

Big banks aren’t just going to accept the new credit card interest cap without a fight. They have to follow the rules, but they’re already making it harder to get approved for a card. If your credit score isn’t great, like around 620, getting a new card could be more difficult. Banks are becoming more selective because they can’t charge high interest rates to make up for the risk of lending to people with low scores. So, you need to pay closer attention to your finances.

How you’ve managed payments for the last two years is now more important than your current balance. Banks want to see stability. If they can’t charge high interest, they want to be sure they’re not lending to someone who won’t pay them back. The credit card rates you see now depend a lot more on your past financial behavior than ever before.

Don’t Get Denied –

The Hidden Cost of Lower Rates

So, if interest rates are capped, how will banks earn? A lot of experts think we’ll see more yearly fees and less generous rewards programs. Those cash back deals and travel points we like are mostly paid for by the high interest that some people pay. With the new Credit Card Rate rules, these perks could vanish first. Banks are really just shifting the cost of credit from interest to fees to keep their shareholders happy.

Credit limits are getting tighter. Instead of getting a $10,000 limit, some borrowers might only get $5,000. Banks do this to manage risk when they aren’t making as much money. It is a classic case of be careful what you wish for.. Lower interest rates might help people who already owe money, but it could be harder for new borrowers to get funds for emergencies. This is already happening across the US.

Expert Opinion: Is the Cap a Double-Edged Sword?

As a financial strategist with ten years of experience, I think this credit card cap is a needed fix, even if it has some downsides. If you’re someone drowning in $15,000 of debt with a 29% interest rate, this could be a lifesaver. It stops your debt from growing out of control and turns never-ending debt into something you can handle. I’ve seen high interest ruin families, and this law gives them a chance to get back on their feet.

On the other hand, if you’re using credit cards smartly to get points, those rewards may disappear. We’re moving toward a banking system more like Europe, where credit is just a tool and not a way to live a luxury lifestyle. The people who will really win are those who already have good credit and can use these lower rates without needing the extras that are going away.

The “BlackRock Trump” Influence on Future Regulations

Looking at finance in 2026, we have to consider pressure from big institutions. There’s talk of BlackRock and Trump joining forces on financial regulations. This means that even though we have interest caps now, we could see a move toward deregulation if the economy weakens. Big investment firms want money flowing, and if banks stop lending because of the caps, we might see new credit options pop up.

Because of this constant back-and-forth between politics and institutions, you can’t just depend on the government to protect your finances. It’s important to keep up with these big changes and how they could affect you each month. The potential BlackRock-Trump period in finance is likely to bring ups and downs and quick shifts, so it’s key to have a credit plan that still works no matter how the rules change.

Strategy: How to Play the New 2026 System

To succeed now, shift your mindset from just being a consumer to thinking like a lender. Since banks are looking at data trends, show a steady decline in your debt. Even paying a bit more than the minimum now matters more. It proves you’re a lower-risk borrower when profits are tight. This habit could mean the difference between a credit limit increase and your account being closed.

Also, watch your current cards. Lenders might change your terms or switch you to a card with an annual fee to make up for losses. Pay attention if they send you an alert about updated terms. This year, being financially invisible will hurt you more than having a small amount of debt that you handle well.

FAQ: Your Questions Answered

1. Does the credit card cap apply to my existing debt?

Yes, the 10% federal interest cap is meant to help with both existing and future balances. Once the rule starts on January 20, 2026, banks must change the APR on your current debt. Keep in mind that it won’t happen right away. Most banks need 30 to 90 days to update their systems. During this time, keep making at least the minimum payments to avoid late fees, as these usually aren’t covered by the interest caps.

2. Will my credit score go down because of these caps?

An interest rate cap won’t hurt your credit score. Lower interest can help you reduce debt faster, which can actually improve your score. Some banks might lower your credit limit to make up for the lower profit from the 10% cap. If this happens and your balance stays the same, your credit utilization ratio will go up, possibly causing a temporary drop in your score. So, keep an eye on your credit limits during 2026 to maintain good credit.

3. Is it still worth getting a new credit card in 2026?

Yes, the way people pick credit cards has to change. Before, rewards points and travel perks were a big deal. But with the new 10% limit, banks will probably cut back on these to save money. Going into 2026, it’s smarter to get cards with fixed low rates or no yearly fees. Instead of just looking at cashback, think about the long-term cost of borrowing. A card with a steady, low APR is way more helpful than a rewards card with sneaky fees.

4. How do these caps affect personal loans?

A credit card rate cap can start a chain reaction in the lending world. If credit card interest rates are capped at, say, 10%, then personal loan companies will probably have to drop their rates too to keep up, especially for debt consolidation loans. So, if you’re stuck with a high-interest personal loan, 2026 could be a good time to shop around for a better deal. Once credit card rates level off, personal loan rates should follow, giving people cheaper ways to handle big expenses and avoid getting stuck in a cycle of debt.

Conclusion: The Shift to Quality over Quantity

The days of juggling a bunch of credit cards for different rewards are probably ending. It’s becoming wiser to just have one or two good, low-interest cards. The credit card limit shows that the American lending free-for-all is being brought under control. Even if it feels limiting, it really pushes us to be smarter with our money.

Stop trying to get points and start trying to pay off your balance. In 2026, the best reward is knowing you aren’t racking up debt while you sleep. Keep your eye on the ball and use these new rules to help you out.